Biggest Difference Makers in Your Retirement Plans

When it comes to making financial decisions for retirement, there are dozens of levers you can pull to change the eventual outcome. You can adjust your savings rate, spending rate, investment selection, your withdrawal strategies, your tax strategies, your start date,...

Navigating the Death of a Spouse: First Steps

If you or someone you know has ever lost a spouse, it is absolutely devastating in every aspect of life. When it comes to personal finances as a widow or widower, there is a seemingly endless “to do” list. Figuring out where to start can be truly daunting. To help get...

Making Your Retirement Transition Seamless

One of the most stressful aspects when retiring, for anyone, is making the transition. One day you’re working, the next you’re not. One week you’re getting a paycheque from your employer, the next you’re not. Lining up your finances to make that transition a smooth...

Does The “70% Rule” Work for Retirement?

If you’ve read virtually any financial literature before, you’ve likely come across the notion of the “70% Rule” for retirement income. The rule simply states that a comfortable retirement income should equal approximately 70% of the after-tax income in your working...

Does It Make Sense to DIY?

If TV ads are to be believed, everyone (and they mean everyone) is better off investing on their own without professional guidance. Platforms alluding to riches, so long as you happen to use their platform, is nothing new. This recent do-it-yourself (DIY) boom of...

Accessing Your Home’s Equity in Retirement

Most Manitobans are familiar with the recent boom in housing prices over the last several years. If you’re fortunate enough to be a homeowner as you enter retirement, this is likely the most real estate equity you’ve had in your lifetime! But how do use that equity to...

The Case for Equities in a Retiree’s Portfolio

For my clients who are approaching retirement, the conversation around de-risking their investment portfolio is a certainty. “When do we stop investing?” “Should we be out of the markets?” These kinds of questions are completely natural. Having lived through the...

Take “Timing Risk” Out of Retirement Savings

If you’re approaching retirement, or even in retirement, you will have some money decisions around large lump sums. When you sell a business, take control over your pension or group RRSP, downsize your home, or even inherit assets, you have choices to make. One of the...

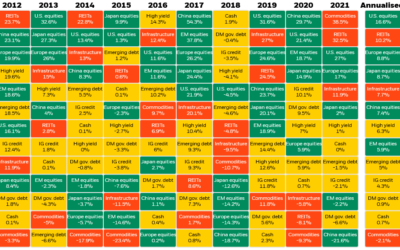

Returns Are Relative

When I was in university, I had a professor put an Asset Class Return Map like this one up on the projector. He said, “if you can spot the pattern, you’ll get to retire in the Bahamas before you’re 25.” The last time I checked, there’s still six feet of snow outside...

How to Handle a Large Lump Sum

Have you ever heard of a lottery winner or professional athlete who went broke after receiving an exorbitant sum of money? According to various news outlets, up to 70% of lottery winners spend it all and former professional athletes are four times more likely than you...

New Year, New Tax Plan

Happy New Year! Let’s welcome in 2022 with a new sense of optimism for the year that lies ahead. To kick the year off right, start by thinking about taxes! Income tax is likely one of the single biggest expenses you have each year. Navigating our tax code can be...

Philanthropy on a Budget

As the Holiday Season approaches, you may find yourself thinking more-and-more about giving to those in need. Dreaming of making a difference for your favourite cause(s) isn’t uncommon. What is uncommon is committing the time, energy and resources to make that...

Four Tips to Add Flexibility to Your Retirement Accounts

What price can you put on ‘flexibility’ when it comes to your money? Being able to make contributions, take withdrawals, adjust amounts, and alter investments, are all valuable components to good retirement planning. How can you set up your investment accounts to...

Year-Round Tax Planning Ideas

For most Manitobans, we try to avoid thinking about taxes any more than we need to. Gathering your T4s and receipts in the new year, passing them along to your accountant in a shoebox, and crossing your fingers for a refund is pretty much the norm. Is there a better...

Avoid Bad Investment Habits in Retirement

You’ve retired! You’re finally at the stage in life where you’ve flipped “off” the savings switch and begun living off your hard-earned assets. Unfortunately, taking an income in retirement isn’t as easy as flipping a switch. There are many considerations to make,...

The Impact of Inflation on Your Retirement

“Inflation” can be a very scary word in Manitobans’ lexicon. Especially if you lived through the hyper-inflationary years of the 70s and 80s! Well “inflation” is making its way back into the headlines as our current economic landscape is driving the cost of living up...

Saving, Investing, or Gambling?

A lot of words in personal finance get used interchangeably. Perhaps none more so than ”investing” and “saving.” You’ve likely seen countless commercials, billboards and flyers recommending you “save for retirement” or “invest for your future.” What’s the real...

Who Gets GIS?

The Guaranteed Income Supplement (GIS) is a social safety net for low-income seniors in Canada. As the name implies, it’s a program meant to supplement your income up to a guaranteed minimum level. When talking with clients, many are aware of the existence of GIS, yet...

Understanding the Canada Pension Plan

Canada Pension Plan (CPP) is truly THE foundational element for most Manitobans’ retirement plans. Created in 1965, CPP has been a mandatory fixture for Canadian employees for decades. You’ve likely noticed deductions off your paycheques to contribute to CPP; perhaps...

4 Personal Finance Tips for the Fourth Quarter

It’s hard to believe that September is approaching its end. Fall is here and we’re looking at only three short months left in 2021! Just because the year is winding down doesn’t mean you should shelve thinking about your finances until the next one arrives. Consider...

“Portfolio Drift” – A Hidden Danger for Your Investments

The last few years have been tumultuous for North American stock markets. March 2020 was one of the sharpest drops in history and, since then, the major indices have rebounded and hit record highs. These rapid changes in equity and bond markets can cause problems for...

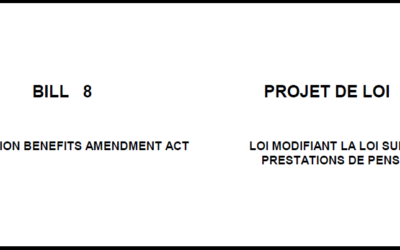

The Impact of Bill 8 On Your Retirement

If you’re a Manitoban who owns any of the following: a pension through work, a Locked-In Retirement Account (LIRA) or a Life Income Fund (LIF), then recent legislation is about to dramatically change your retirement vision. Bill 8, titled “the Pension Benefits...

The Impact of Interest Rates on Your Pension

Manitoba is home to many, many industries that feature pension programs. Education, Finance, Healthcare, Manitoba Hydro, the list goes on and on! If you contribute to a defined benefit pension through work, you may have noticed an interesting trend: the commuted value...

Why Financial Advice NEEDS to be Custom

If you’re a regular reader of my blogs, you’ll likely see a common trend. I never recommend one particular outcome for everyone. I instead devote this space to weighing pros and cons and identifying pitfalls or opportunities. The reason for seeming indecisive?...

Life Insurance in Retirement

According to the Canadian Life and Health Insurance Association, the average Canadian Household owns $432,000 of life insurance coverage. That’s a lot of money in play when determining what expenses to keep and which ones to cut in retirement. Do you keep paying...

How Should You Handle An Inheritance?

People can come into lump sums of money in countless ways. Maybe you win the lottery (unlikely), sell a business or property, or perhaps you receive an inheritance from a loved one’s passing. Inherited money is inherently different than money from other ventures. So...

The Major Financial Milestones of Retirement

Life has many milestones. From graduating school to finding your first job, buying your first car to buying your first home, and many more! As you begin to hit your “retirement years,” the milestones don’t stop there. In fact, there are many important milestone ages...

How To Maximize Your TFSAs For Retirement

Tax Free Savings Accounts (TFSAs) are a relatively new tool in the Canadian financial landscape. Introduced in 2009, the TFSA has become more and more important to Manitobans’ retirement plans as time goes on. How can a person make the most out of this unique...

Should I Buy An Annuity With My Pension?

I recently worked with a client who was weighing the options for his defined benefit pension. He had retired early and was given three choices for his plan: A) take the monthly payment from his pension company, B) commute the lump sum value, and C) buy an annuity from...

How To Protect Your Retirement From The Next Market Drop

It’s not a matter of “if” the market will drop again… it’s a matter of “when” the market will drop again. We’re only a little over a year removed from the fastest market decline in Canadian history. From February 21, 2020 to March 20, 2020, the Toronto Stock Exchange...